March Residential Highlights

The Portland metro area had

a sunny month for new listings

this March. At 3,604, new listings

outpaced March 2016 (3,409) by

5.7% and February 2017 (2,521) by

43.0%. This was the strongest March

for new listings in the area since

2010, when 4,987 were offered for

the month.

Pending sales (3,043) warmed

28.5% over last month in February

2017 (2,369) but fell 1.1% short of

the 3,076 offers accepted during this month last year in March 2016. Closed sales, at 2,494, similarly

outpaced February 2017 (1,669) by

49.4% but still ended 2.8% cooler

than in March 2016 when 2,565

closings were recorded for the

month.

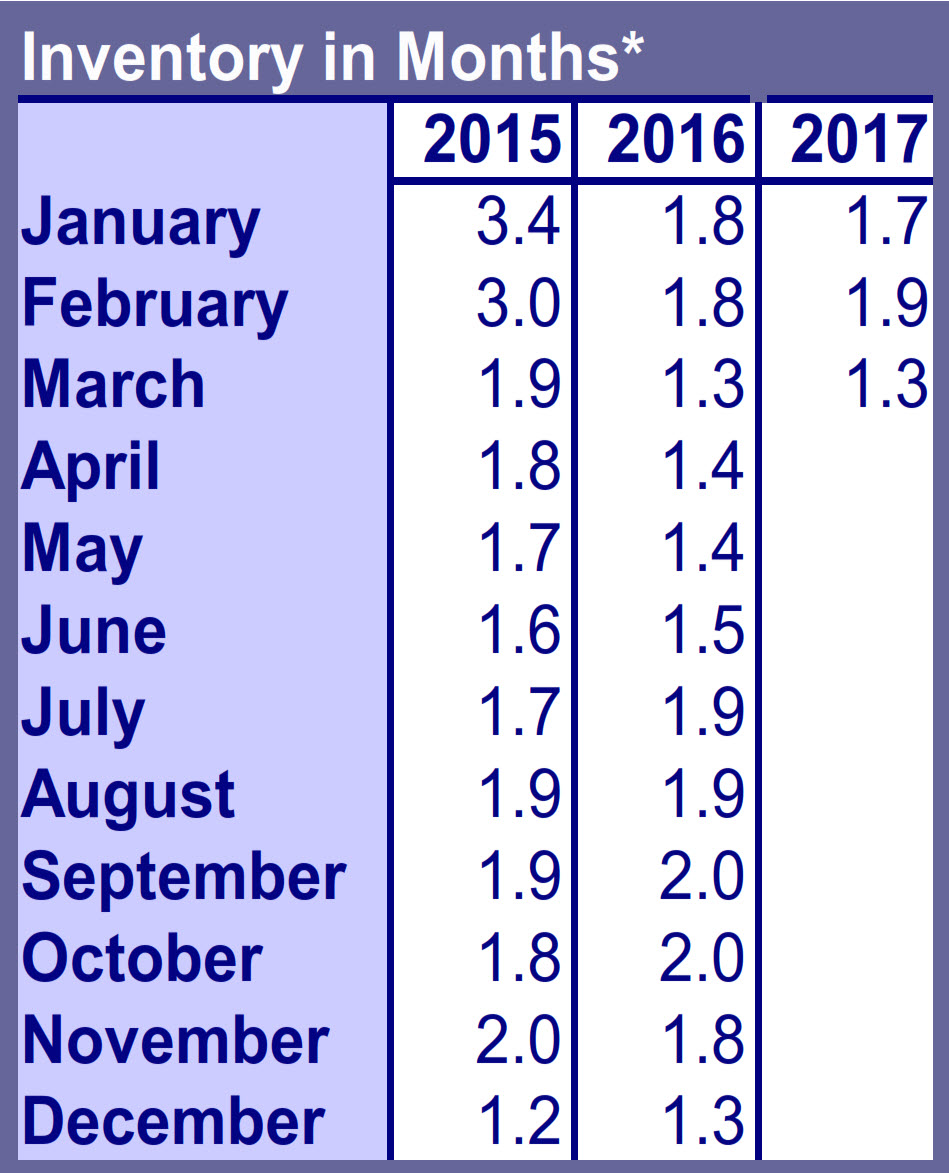

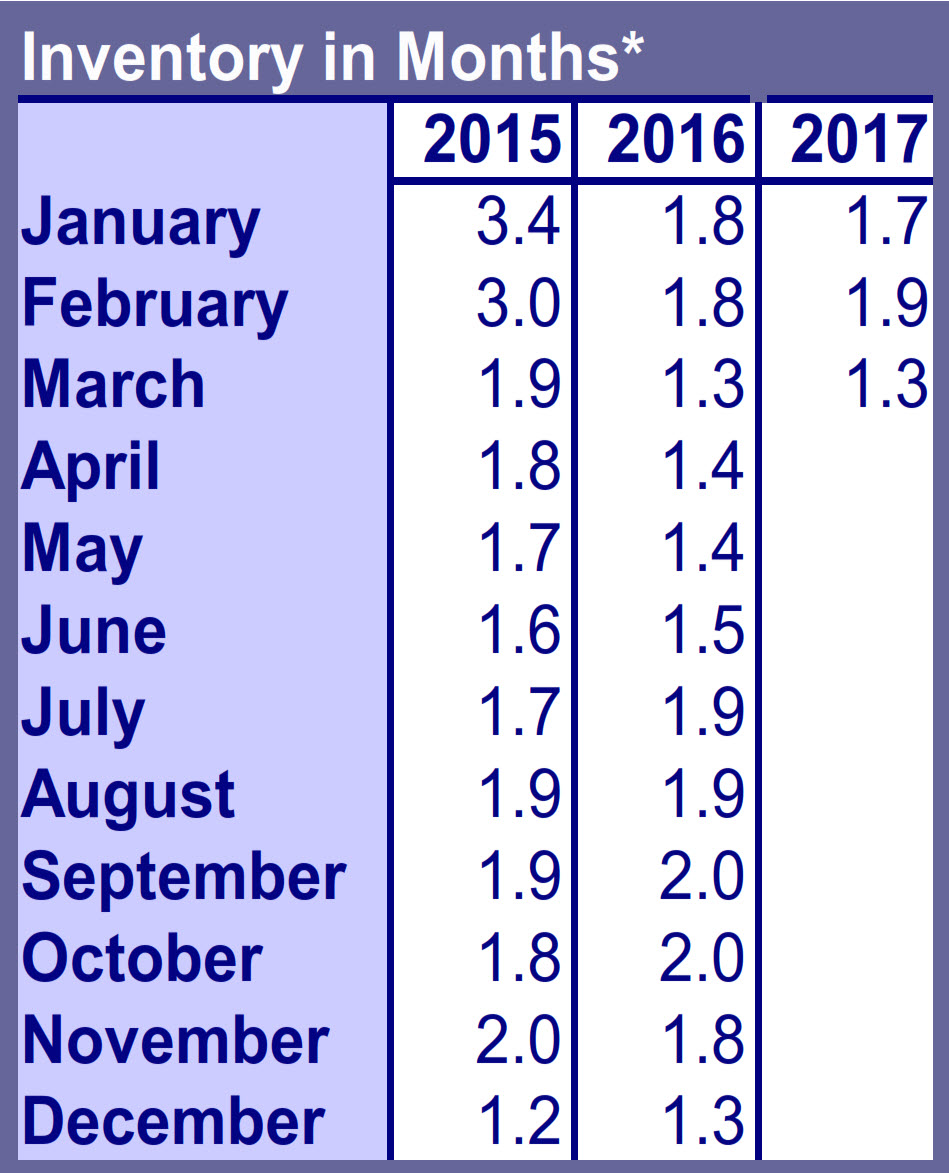

Total market time decreased by

four days this March, ending at 58

days. Inventory decreased as well,

ending at 1.3 months. There were

3,313 active residential listings in

the Portland metro area this March.

Average and Median Sale Prices

Comparing the average price of

homes sold in the twelve months

ending March 31st of this year

($404,300) with the average price

of homes in the twelve months

ending March 2016 ($361,100)

shows an increase of 12.0%. In the

same comparison, the median has

increased 12.2% from $315,000 to

$353,500.

March Residential Highlights The Portland metro area hada sunny month for new listings this March. At 3,604, new listings outpaced March 2016 (3,409) by 5.7% and February 2017 (2,521) by 43.0%. This was the strongest March for new listings in the area since 2010, when 4,987 were offered for the month. Pending sales (3,043) warmed 28.5% over last month in February 2017 (2,369) but fell 1.1% short of the 3,076 offers accepted during this month last year in March 2016. Closed sales, at 2,494, similarly outpaced February 2017 (1,669) by 49.4% but still ended 2.8% cooler than in March 2016 when 2,565 closings were recorded for the month. Total market time decreased by four days this March, ending at 58 days.

March Residential Highlights The Portland metro area hada sunny month for new listings this March. At 3,604, new listings outpaced March 2016 (3,409) by 5.7% and February 2017 (2,521) by 43.0%. This was the strongest March for new listings in the area since 2010, when 4,987 were offered for the month. Pending sales (3,043) warmed 28.5% over last month in February 2017 (2,369) but fell 1.1% short of the 3,076 offers accepted during this month last year in March 2016. Closed sales, at 2,494, similarly outpaced February 2017 (1,669) by 49.4% but still ended 2.8% cooler than in March 2016 when 2,565 closings were recorded for the month. Total market time decreased by four days this March, ending at 58 days.

Inventory decreased as well, ending at 1.3 months. There were 3,313 active residential listings in the Portland metro area this March. Average and Median Sale Prices Comparing the average price of homes sold in the twelve months ending March 31st of this year ($404,300) with the average price of homes in the twelve months ending March 2016 ($361,100) shows an increase of 12.0%. In the same comparison, the median has increased 12.2% from $315,000 to $353,500.

This months chart shows the inventory of available homes in the Portland Metro area dating back to January of 2015. A "balanced" market as defined by HUD and the National Assn Realtors is 5.5-6 months of inventory, and as you can see we are far short of that with only 1.3 months of supply right now. If you have been considering selling your home, now might be the time to do so.

This months featured home is an amazing estate on the Willamette river in West Linn. This 4,436 square foot custom built home sits overlooking the river with a huge great room with Brazilian cherry floors, and an incredible gourmet kitchen with a massive island and American cherry cabinets and much more. There is a formal dining room plus a small master and office on the main floor. Upper level has the spacious master suite, plus two additional bedrooms and a bonus room too. All bedrooms have their own balconies. This home also sits above a five plus car garage, with a pull through door leading to a boat ramp the river, and has a dock too! Check it out at http://www.roblevy.com/Property/4993-MAPLETON-DR-West-Linn-17380137

This article in the New York Times recently talks mostly about the boom in Denver (a city with similar price increases and inventory woes as Portland) But I can tell you as a Realtor for almost 30 years now in Portland while we have always been known as "pot friendly" and I have always had 3-5 people a year asking me about grow operations this last 12 months or so its coming up all the time! Oregon has some specific laws on what you can do personally (grow up to four plants) but we have had several real estate sales recently for buyers in the cannabis industry. You can see the article here...

This article in the New York Times recently talks mostly about the boom in Denver (a city with similar price increases and inventory woes as Portland) But I can tell you as a Realtor for almost 30 years now in Portland while we have always been known as "pot friendly" and I have always had 3-5 people a year asking me about grow operations this last 12 months or so its coming up all the time! Oregon has some specific laws on what you can do personally (grow up to four plants) but we have had several real estate sales recently for buyers in the cannabis industry. You can see the article here... March Residential Highlights The Portland metro area hada sunny month for new listings this March. At 3,604, new listings outpaced March 2016 (3,409) by 5.7% and February 2017 (2,521) by 43.0%. This was the strongest March for new listings in the area since 2010, when 4,987 were offered for the month. Pending sales (3,043) warmed 28.5% over last month in February 2017 (2,369) but fell 1.1% short of the 3,076 offers accepted during this month last year in March 2016. Closed sales, at 2,494, similarly outpaced February 2017 (1,669) by 49.4% but still ended 2.8% cooler than in March 2016 when 2,565 closings were recorded for the month. Total market time decreased by four days this March, ending at 58 days.

March Residential Highlights The Portland metro area hada sunny month for new listings this March. At 3,604, new listings outpaced March 2016 (3,409) by 5.7% and February 2017 (2,521) by 43.0%. This was the strongest March for new listings in the area since 2010, when 4,987 were offered for the month. Pending sales (3,043) warmed 28.5% over last month in February 2017 (2,369) but fell 1.1% short of the 3,076 offers accepted during this month last year in March 2016. Closed sales, at 2,494, similarly outpaced February 2017 (1,669) by 49.4% but still ended 2.8% cooler than in March 2016 when 2,565 closings were recorded for the month. Total market time decreased by four days this March, ending at 58 days. Here is a great article from USA Today with a solid 50 things that a home buyer (and also seller who is selling to buy) can and should do to prepare for the exercise. I can honestly say in my almost 30 years as one of Portland's top selling Realtors that every one of these can trip someone up. Check out the list on the USA Today site.....

Here is a great article from USA Today with a solid 50 things that a home buyer (and also seller who is selling to buy) can and should do to prepare for the exercise. I can honestly say in my almost 30 years as one of Portland's top selling Realtors that every one of these can trip someone up. Check out the list on the USA Today site.....