Why refinancing is not always the best option

Even with the super low rates of today, refinancing may not always be the best option. "What?" you say. Are you nuts Rob? Rates are at historical lows.

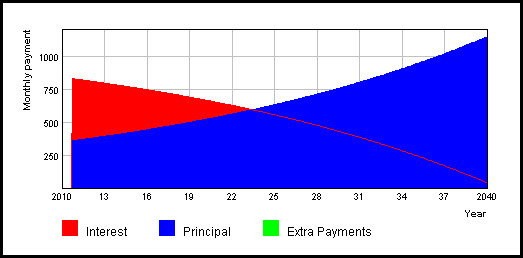

This is all true, but keep in mind that in the US the way interest is calculated, the majority of it is paid in the first half of the loan period, so if you recently took out the loan, you are probably better off refinancing even if the rate drop is minimal. SEE CHART AT BOTTOM FOR EXAMPLE.

In my case my wife and I were 79 months into a 15 year (180 month) loan, so about half way. On a 15 year you really start paying off a lot of principal about 5 years in (its about 12 years on a 30 year). In our case the rate drop was over 1% and the payment drop was $890 a month. Now that's a lot cheaper I know, but it also started all over again on a 15 year mortgage so it wouldn't be paid off for 15 years and for the next five as above I would be paying mostly interest all over again. BUT - I got to thinking, what if I took out the new loan and kept paying my OLD payment, what would the accelerated payoff now be? Well guess what, it works out to be paid off within two months of if I do nothing and keep the current loan. So to be clear the advantage of getting the new loan would be that I have $890 a month less debt and of course over the long run pay a lot less interest.

So the advantage here (smaller payment commitment) outweighed the negative (longer term) as it makes it $890 a month easier to qualify for any future loan. As a result, we decided to take out the new loan and I am making my OLD payments just like I used to using Wels Fargo Bill Pay where I simply typed in a monthly auto-pay of the old payment.

You can and should check this for yourself with an online calculator. TRY THIS MORTGAGE CALCULATOR where you can type in additional principal paid monthly and see the results. Go ahead and play with it, it's amazing. The chart showing where you actually start paying off any decent amount of principal is below. This example is for a $250,000 mortgage over 30 years at 4.5%.